Big trucks got hit from every direction in 2008. First, gas prices soared to over $4 a gallon. Then, a mortgage crisis crunched new home construction, a big market driver for trucks. Then a national economic crisis drove down all new vehicle sales.

Things got so bad that Ford delayed the introduction of its new, redesigned 2009 F-150 (shown here) so dealers would have time to sell down their inventory of the old 2008 model.

Still, for the 27th consecutive year, the Ford F-series was America’s top-selling vehicle of any sort. All in all, Ford sold 475,240 F-series trucks in 2008, according to the automotive Web site Edmunds.com.

Trucks, and the F-series in particular, have an advantage over cars in this race. First, trucks are bought for personal use and in large numbers for fleet and business use. Second, there are simply fewer large truck models for buyers to choose from.

And third, each model is available in a mind-boggling array of sizes, body styles and engine types. The F-series benefits in particular because it doesn’t sell under two different names, the way the Chevrolet Silverado/GMC Sierra does.

If you combine GM’s two brands of big trucks, they actually outsold the F-series by almost 160,000 units.

Like the F-150, the Camry has become a perennial winner, landing the spot of “Best selling car” with 2008 sales of 436,617, according to Edmunds.com. That includes the Camry Hybrid and the two-door Solara,. It’s won this race for ten of the last 11 years. (The Honda Accord took the crown eight years ago.)

In many ways, the Camry’s run is even more impressive than that of the F-series. Buyers have plenty of mid-size cars to choose from, including the Honda Accord, Ford Fusion and Chevrolet Malibu. But the Camry has become the default, idiot-proof choice among American car buyers. Those who don’t know the first thing about cars know that, at the very least, they’re getting a good, dependable vehicle in the Camry.

That’s what every one of its competitors is up against. You don’t just have to make a better car, you have to get thousands of skeptical Americans to believe you and put their hard-earned cash on the line. At best, it’s going to take a long time for anyone to knock the Camry off this perch.

For decades, it’s been a two-horse race between Chevrolet and Ford. But this year, Toyota’s Toyota brand - not counting Scion and Lexus - came out ahead simply because Chevy and Ford sales sank much further than Toyota’s.

It was pretty close though. Toyota sold 1,843,669 cars this year. Chevrolet came in second with 1,790,519 sales.

But don’t look for Toyota to be doing that “Oh what a feeling!” jump. They’d rather that everyone’s sales went up, including theirs, even if they didn’t come out on top.

Better a rising tide that lifts all boats then getting beached on the highest rock in the harbor.

Nobody did well this year. Even Honda, which managed gains during the gas-price crush when just about every other brand suffered declines, finished the year with about 7% lower sales than in 2007. The biggest winner, in percentage terms, was Mini which sold 28.6% more cars this year than last.

Mini’s diet-sized fuel consumption certainly helped, but the recent introduction of a second model to its one-car line-up probably helped even more. The Mini Cooper Clubman, which has more storage room and slightly more back seat space, made the brand accessible for drivers who needed more practicality.

Jaguar also managed a slight sales increase, thanks to its fancy new XF. But among major auto brands, only Subaru managed even a very slight increase in sales. Credit goes to a few key models, most notably the new Forester crossover SUV that won Motor Trend’s “SUV of the Year” as well as recognition as the best small SUV by Consumer Reports.

It’s no surprise that Hummer had the worst sales fall-off of any brand in America last year, dropping by half to 27,485.

The bottom line is that high gas prices pushed customers away from truck-based SUVs, which are all Hummer sells.

And as a love-it-or-loath-it niche product, Hummer has always been highly dependent on new model introductions that sell hot for a while, then fizzle.

When sales of the original H1 started to fade, the smaller H2 came in to pick up the slack. Then, as the H2’s welcome wore thin, in rode the smaller-yet H3.

But with H3 sales way down, Hummer could use another all-new product. (The Hummer H3T, shown here, just isn’t new enough, or small enough, to do it.) But that will have to wait while GM decides whether to sell the brand or keep it.

By the end of the year, Honda’s sales were down slightly, but nearly every other brand was down more. That added up to a 1.2% market share gain for Honda.

Honda never got pulled into the whole big SUV thing and that made the brand look very, very smart when gas prices summited the $4 mountain this summer.

Honda sales slacked off as gas sledded down the other side in the fall, but not enough to take away that market share gain for the year.

In terms of market share, Chrysler LLC’s Chrysler brand suffered the worst loss in 2008, according to data from Edmunds.com.

Fortunately (if you can call this fortunate) almost everyone else’s sales suffered, so despite a 39% overall drop-off, Chrysler’s market share decreased by just 0.88%. Not at all good, but not as bad as you might have thought.

The runner-up in this category was another Chrysler brand, Dodge, which lost 0.76% of its market share.

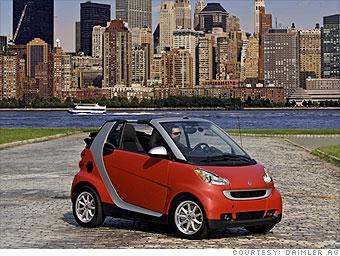

Germany’s Daimler had been talking for years about selling the tiny Smart ForTwo in the United States. The idea sounded just as strange as the car looks. Daimler’s Smart division had been a money-loser even in Europe where high gas prices push consumers toward small vehicles.

Why would Americans, who pay less than half as much for gasoline, sacrifice size and practicality to buy the two-seat ForTwo? There seemed to be only one compelling reason: It was so darned cute.

But then, just as the ForTwo began arriving at American ports, gas prices shot up. It arrived just as Americans were most willing to sacrifice roomy comfort for the sake of fuel economy.

The subsequent, and equally startling, drop in gas prices has done nothing to stem sales, though, said Smart spokesman Ken Kettenbeil. Still, by the end of the year, Smart’s overall market share was just 0.2% - matching that of Hummer.

If the Smart ForTwo got lucky because of high gas prices, the Kia Borrego crapped out. Kia is known for inexpensive small cars, but it went to great pains to stretch into a new vehicle segment with the Borrego midsize truck-based SUV.

To be fair, planning a new vehicle is always a little dicey. A typical new model takes about five years to get to market. During that time, gas prices rise and fall and rise again, consumer tastes change and competitors come out with new options.

“Maybe the timing wasn’t the best, but there are still those who need this type of vehicle,” said Kia spokesman Chaz Abbot “and for us to succeed we don’t need that big of a share.”

But Kia should have noticed all the passengers queuing up for the lifeboats on the ship they were about to board. Other automakers had long been coming out with new crossover models and taking the focus off their slow-selling SUVs.

Runner-up: Hummer H3T

Introducing a new Hummer truck even as truck sales are tanking and GM is looking to sell the underperforming Hummer brand may seem like a sure-fire winner in this category.

But the H3T is a variant of an existing vehicle so it took no great investment on GM’s part and, even if it sells poorly, it will at least squeeze a few more sales out of GM’s H3 production line. You can’t really fault them for that.

0 comments

Post a Comment